Author: Adam Vranka| 6 min. reading

For many years, traditional television was the unchallenged leader in how people spent their time in front of a television screen, and it did not face any significant competition or threat for a long time during its existence. But that has changed with the advent of streaming services, which are growing in popularity every year and in some countries will be more widely used than traditional TV within a few years. Most of us have probably tried, or at least heard of, a streaming platform or service such as Netflix, Amazon Prime Video or Disney Plus. There are a number of reasons why people prefer streaming platforms. We can list the most important ones. Flexibility is cited as one of their biggest advantages. Users don't have to adapt to the strict schedule of traditional televisions and can watch the content they want to see, anytime and anywhere. Another advantage is the abundance of quality and personalised content. Streaming platforms offer a wide range of content, including series, movies or documentaries, which are regularly rotated and recommended to the user based on past viewing data. There are also the advantages of no ads, lower costs, but also no tie-ins, which means that the user can cancel the subscription at any time.

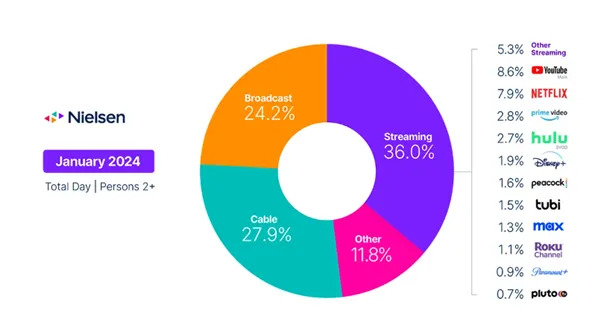

The figure below shows how viewers in the US spent their time in front of a TV screen in January this year. We can see that 36% of time in front of TV screens was accounted for by streaming. Classic TV includes the Broadcast and Cable categories, which together accounted for around 52%. In Europe, while streaming doesn't make up as large a portion as in the US, its share is growing every year.

Source: Colder weather and NFL playoffs drive increased TV usage in January (February 2024). The Nielsen Company. Available at Nielsen: https://www.nielsen.com/insights/2024/colder-weather-and-nfl-playoffs-drive-increased-tv-usage-in-january/

The biggest players

Netflix

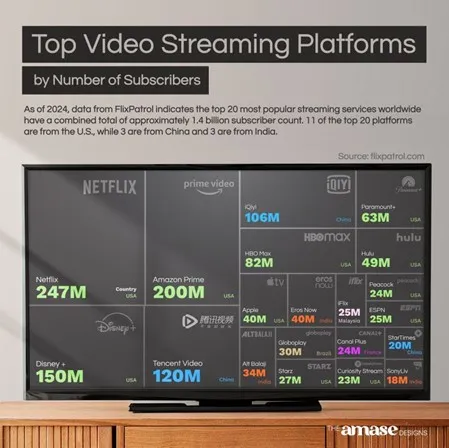

Probably the most well-known and one of the early players in the streaming space is Netflix. The company, which was originally a DVD rental company, has managed to grow into the biggest player in the field in terms of subscribers over the years of its existence. Netflix saw the future in streaming movie content and introduced it back in 2007. With this decision, we could say that it revolutionised the film industry. It surpassed the 100 million subscriber mark in 2017. Currently, Netflix already has around 250 million of them. Interestingly, according to the data, Slovakia has the largest "Netflix library" with 8 427 titles (data as of March 2023 published by Statista).

Amazon

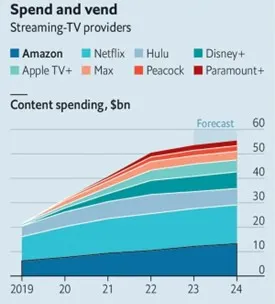

Amazon is in business in a number of areas, and it may come as a surprise to many that it also has its own streaming service. In terms of subscribers, it's even the second largest after Netflix. Amazon Prime Video is not that well known in our country. However, it is very popular in the US and more than 150 million Americans use it there. In 2023, Amazon spent around USD 12 billion on movie content for its platform, only Netflix spent more last year. We can see how much each streaming platform spends on its content in the figure on the right. Amazon Prime Video can be subscribed to separately or as part of the Amazon Prime service, in which users have other benefits than just the streaming service. In the US, it is the latter option that is very popular.

Source: Amazon has Hollywood’s worst shows but its best business model (27 August, 2023). Economist, Ampere Analysis. Available at: https://www.economist.com/business/2023/08/27/amazon-has-hollywoods-worst-shows-but-its-best-business-model

Disney

Disney ranks third globally in terms of subscribers. Disney is known for its animated films and theme parks, which have a long tradition. On their streaming platform we can also find movies and series under the Marvel or Star Wars brands, which have been very popular in recent years. Disney Plus has around 150 million subscribers worldwide. Disney also owns the streaming services Hulu and ESPN+, on which users can watch live various sports. In the figure below we can see the largest streaming services in terms of subscribers (data in millions).

Source: Winifred, Amase. Top video streaming platforms by subscibers (January 29,2024). The Amase Designs, Flixpatrol. Available at Linkedin: https://www.linkedin.com/posts/winifred-amase-91092b40_streaming-video-netflix-activity-7157720839864422400-AJMo

Streaming and sport

Streaming platforms have to keep renewing their "movie library", innovating and coming up with something new so that their users don't switch to competitors or back to classic TV. Probably the biggest trend or novelty we can see in recent years in this sector is the streaming of sports. Streaming services already own and are still buying additional rights to broadcast various sports, allowing users to watch these sports exclusively on their platforms. Sport is an important segment, especially in the US, and is expected to grow in importance in Europe as well and will play a very important role in the streaming sector in the future.

Recently, we have even seen a new collaboration regarding streaming sports. Disney, Warner Bros Discovery and Fox have announced a partnership that they hope will allow them to compete with big companies such as Amazon, Apple or Alphabet. It is these companies that have bought the rights to stream a number of sports in recent years. Amazon pays one billion dollars a year to stream Thursday Night Football. Apple, for its part, bought the rights to broadcast the American soccer league MLS for 10 years for 2.5 billion dollars. There is speculation that Apple is also interested in the rights to the NBA and Formula 1. The estimated price for the rights to Formula 1 is expected to be around 2 billion dollars per season.

The biggest player in streaming - Netflix - is not slacking off in this category either. Earlier this year, it announced a 10-year, 5 billion dollars deal with WWE that will allow it to stream wrestling on its platform. Netflix also hosts its own sporting events, which it streams on its platform. The most recent one was a tennis event called the Netflix Slam, which featured a match between tennis stars Nadal and Alcaraz. This year, we will also be able to watch a boxing match on Netflix, which will see boxing legend Mike Tyson take on influencer Jake Paul.

In the picture we can see the distribution of sports rights in the USA. The newly announced service from Disney, Warner Bros Discovery and Fox is expected to include around 55% of US sports rights.

Source: Canal, Alexandra. The ESPN-Fox-WBD sports venture is a counterstrike against Big Tech and rights fees inflation. Here's how (February 7,2024). City Research, Yahoo Finance. Available at Yahoo Finance: https://finance.yahoo.com/news/the-espn-fox-wbd-sports-venture-is-a-counterstrike-against-big-tech-and-rights-fees-inflation-heres-how-191534965.html

Streaming platforms in Slovakia

Televisions such as Markiza or JOJ in Slovakia see the growing popularity of streaming platforms and therefore they also have their own streaming platforms. The content of Markiza TV station can be found on the streaming service VOYO, which is very popular in Slovakia. JOJ has its own streaming service, JOJ play. In the second half of last year, VOYO reported 650,000 paying customers in the Czech Republic and Slovakia. Netflix and other global streaming services do not report the number of subscribers per country. However, the assumption is that Netflix is the market leader in Slovakia, followed by VOYO. Disney Plus and HBO MAX are likely to follow in third and fourth place.

Conclusion

Streaming platforms have disrupted the "long-standing monopoly" of classic TV, and many people refer to them as the future of TV entertainment. Classic TVs are trying to innovate and adapt to user demands. They are developing their own apps or streaming services, which are available on modern smart TVs. But only the future will tell for sure whether this will be enough and who will dominate 'TV entertainment'. Shares of the biggest players in the streaming sector can also be found in several of our funds, such as the Fond budúcnosti, Aktívne portfólio alebo Fond maximalizovaných výnosov.

Disclaimer: This document is a marketing communication and is intended as a supplementary source of information for investors and is based on the best sources of information available at the time of its production. The analyses and conclusions presented are general in nature and do not take into account the individual needs of investors in terms of yield, taxation and level of acceptable risk. The information has been prepared without taking into account the personal circumstances of the potential recipients and their knowledge and experience in the field of investment, does not constitute the provision of investment advice or investment research, is not a proposal for the conclusion of a transaction by the management company and does not imply any commitment. Past returns from an investment in mutual funds are not a guarantee of future returns. The source of the information used is Erste Asset Management GmbH, with registered office at Am Belvedere 1, 1100 Vienna, Austria, registered in the Commercial Register of the Commercial Court of Vienna under registration number 102018 b, doing business in the Slovak Republic through the organizational unit Erste Asset Management GmbH, branch office Slovak Republic, with registered office at Tomášikova 48, 832 65 Bratislava, ID No.: 51 410 818, registered in the Commercial Register of the Municipal Court of Bratislava III, Section: Po, Insert No.: 51 410 818, registered in the Commercial Register of the Municipal Court of Bratislava III, Section: Po, Insert No. 4550/B, unless otherwise specified. The information contained herein may not be further disseminated without the prior consent of Erste Asset Management GmbH, Branch Office in the Slovak Republic.