Author: Adam Vranka | 5 min. reading

Exactly 55 years ago, a small group of scientists from the University of California managed to send the first message over the ARPANET computer network. The first message sent was to the Stanford Research Institute, and its content was "LO". The message was supposed to contain the word "LOGIN" but the system crashed as soon as the two letters were sent. Back then it was not the Internet as we know it today, but it created a foundation on which to build.

Over the next 55 years, the Internet has undergone an interesting evolution and dealt with various obstacles. In 1969, no one expected that the ARPA Institute network, which was set up by the US Department of Defense, would change the lives of almost everyone on the planet. According to the Statista platform, approximately 67% of the world's population uses the Internet.

Many companies have used the Internet to their advantage, and for many it is still the basis of their business today. And it is the combined market capitalisation of the 3 largest Internet companies - Alphabet (Google's parent company), Amazon and Meta Platforms - that recently surpassed the USD 5 trillion milestone.

Source: Google Finance

In the figure we can see the price per share of these companies and their performance since the beginning of the year. The market capitalisation of these companies has grown by more than $1 trillion in total this year alone. Such increases are not entirely normal in historical terms. So what is behind this extraordinary growth?

Rocketing growth driven largely by AI and a resilient U.S. economy

Artificial intelligence, or AI, a term we've all come across many times over the past few years. But these companies have been able to harness this technology and are already claiming that we can see its impact and it's translating into company-wide profits for them. AI is helping these companies in many areas, for example, it's streamlining their processes which leads to time and cost savings, or they are using it to better and more accurately target advertising and products to customers. For example, Meta CEO Mark Zuckerberg, while announcing its latest financial results, said that better targeting with AI helped increase time spent on Facebook by 8% and on Instagram by 6%. Microsoft CEO Satya Nadella, for his part, expects AI revenue to soon reach $10 billion a year.

The US economy, which surprisingly to many is still resilient and in very good shape, has also played its part in the growth of these companies. Macroeconomic indicators such as unemployment, economic growth or inflation are developing positively and no significant change is currently expected until the next few months. This is also the reason why not only the shares of the aforementioned companies are trading at all-time price highs. We have also recently seen historic highs on all three major US stock indices, the Dow Jones, the S&P 500 and the Nasdaq Composite.

Nothing is free

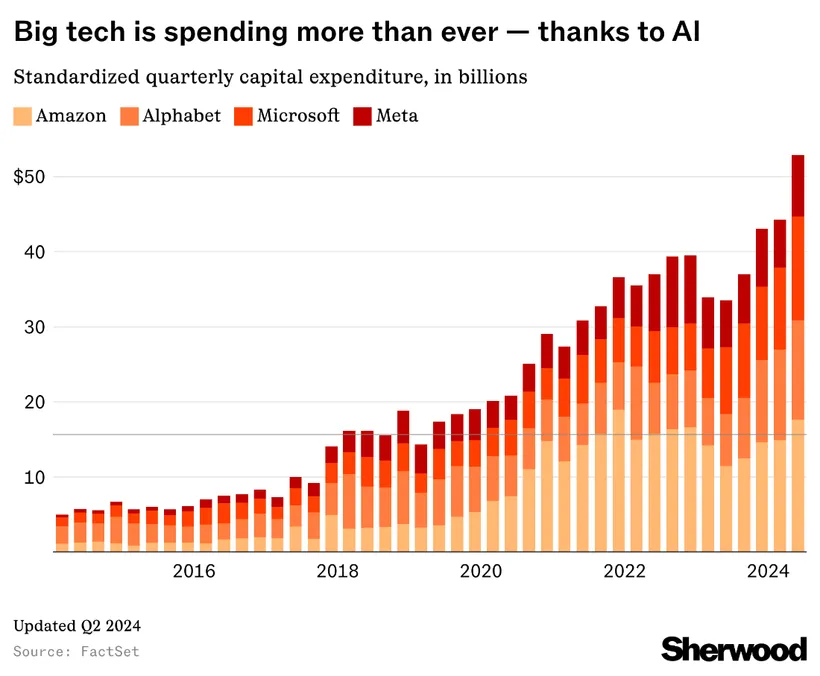

Investment in AI, and more specifically in the data centers that provide the computing capacity and power artificial intelligence, is getting higher and higher every year. We're talking tens of billions of dollars every quarter. While many shareholders feel that this spending is too much and has a negative impact on profit margins, the CEOs of these companies say that spending on AI is justified and should be even higher in future years. In their view, artificial intelligence represents a unique opportunity, and in the words of Alphabet CEO Sundar Pichai, the risk of under-investing in AI is dramatically higher than the risk of over-investing.

Source: Molla, Rani. Big tech’s huge AI spending isn’t slowing down. The revenue? Uhhhhh... (May 8,2024). FactSet, Sherwood. Available at Sherwood: https://sherwood.news/tech/meta-amazon-microsoft-massive-ai-capex-spending-quarterly-earnings/

In the figure we can see capital expenditures (CAPEX) of the four Big tech companies for each quarter. Recently, these 4 companies reported their financial results for the third quarter of 2024 and together their cost of capital for that quarter was around $60 billion. A large portion of these costs are mainly going towards AI infrastructure investments. Analysts at US City Bank expect the four companies' capital expenditure for the full year to reach $209 billion, up 42% year-on-year.

Conclusion

It is questionable whether artificial intelligence is so disruptive and beneficial that these companies are investing tens of billions of dollars in it each quarter. Only the future will tell. But to return to the introduction, nobody expected the first computer network to change the way the world works either. Smartphones are owned by nearly 70% of the planet's population , according to Statista. Without the internet, their use would certainly be much smaller.

Expectations for AI are currently high, and this is reflected in the valuations of the stocks of these large companies. But valuations are already high for many investors, and sometimes all it takes is a small hesitation or disappointing financial results for a stock to fall more than 5% in a day. Either way, the reality is that at least one of these companies forms the basis of many investors' portfolios or mutual funds, and also the basis of most of the world's digital life. Shares of these companies can also be found in a number of our mutual funds offered in the Slovakia, such as the equity funds Fond maximalizovaných výnosov, ERSTE STOCK TECHNO, Fond budúcnosti or the mixed fund Active Portfolio.

Disclaimer: This document is a marketing communication and is intended as a supplementary source of information for investors and is based on the best sources of information available at the time of its production. The analyses and conclusions presented are general in nature and do not take into account the individual needs of investors in terms of yield, taxation and level of acceptable risk. The information has been prepared without taking into account the personal circumstances of the potential recipients and their knowledge and experience in the field of investment, does not constitute the provision of investment advice or investment research, is not a proposal for the conclusion of a transaction by the management company and does not imply any commitment. Past returns from an investment in mutual funds are not a guarantee of future returns. The source of the information used is Erste Asset Management GmbH, with registered office at Am Belvedere 1, 1100 Vienna, Austria, registered in the Commercial Register of the Commercial Court of Vienna under registration number 102018 b, doing business in the Slovak Republic through the organizational unit Erste Asset Management GmbH, branch office Slovak Republic, with registered office at Tomášikova 48, 832 65 Bratislava, ID No.: 51 410 818, registered in the Commercial Register of the Municipal Court of Bratislava III, Section: Po, Insert No.: 51 410 818, registered in the Commercial Register of the Municipal Court of Bratislava III, Section: Po, Insert No. 4550/B, unless otherwise specified. The information contained herein may not be further disseminated without the prior consent of Erste Asset Management GmbH, Branch Office in the Slovak Republic.